This is becoming an increasingly popular method of purchasing. This has two main financing options, Personal Contract Hire (PCH) or Personal Contract Purchase (PCP).

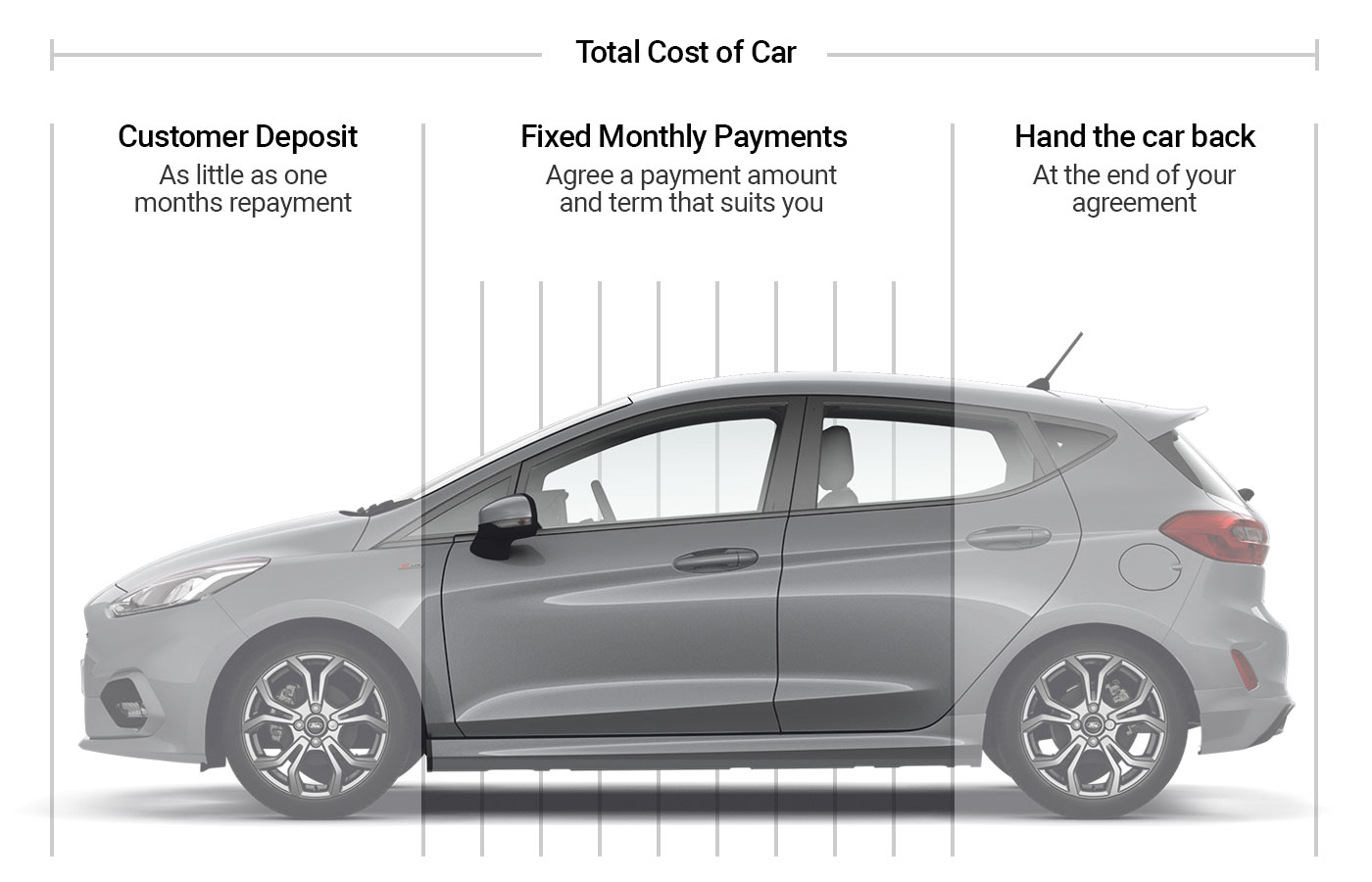

The idea is simple, choose a car, length of agreement and anticipated mileage. Then pay a monthly sum over a set period of time, usually 2 or 3 years and return the vehicle at the end of the agreement. This enables you to change your vehicle regularly and avoiding the costs of owning a vehicle.

Small initial deposit

No risk from residual value loss

You can frequently change your vehicle

Road fund licence is included for the duration of the contract

Allows customers to experience the benefits of driving a new vehicle on a regular change-cycle basis without the often large depreciation costs associated with owning new vehicles outright

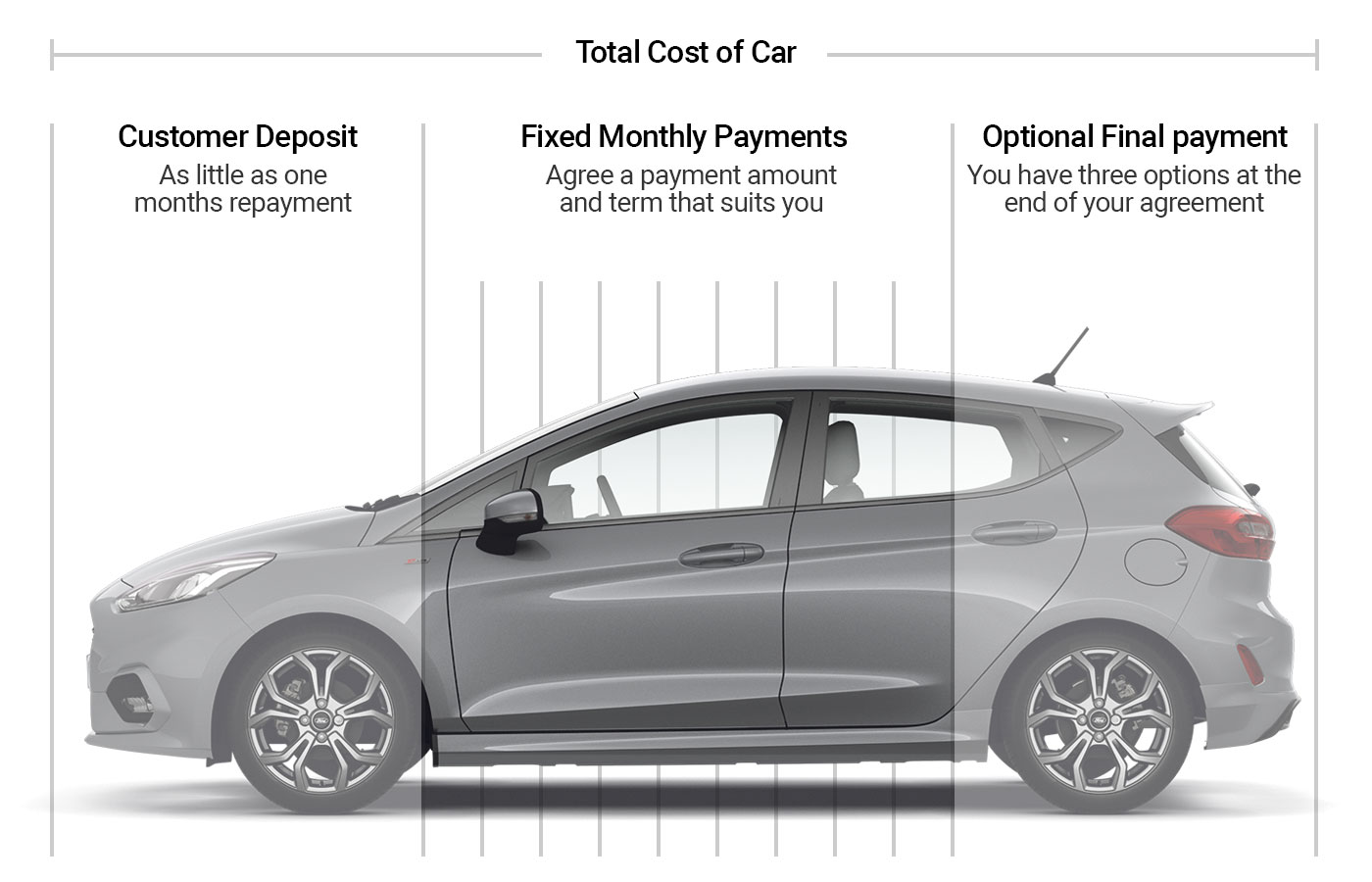

This is very similar to PCH, again having payments over a set period of time and set mileage. The main difference with this agreement is the inclusion of a final balloon payment. This allows you to purchase the vehicle at a price agreed at the beginning of the term. This payment is called Guaranteed Minimum Future Value (GMFV) which means the minimum projected cost of the vehicle at the end of the agreed contract.

A PCP can be settled by the customer at any time if they pay the balance outstanding, including the GMFV to the lender. At the end of the PCP agreement the customer has three options:

1. Part exchange for another car

2. Pay the final payment and keep the car

3. Return the car and walk away

A very popular and flexible way of purchasing a vehicle that is structured to allow a customer to change into a vehicle of their choice, at a time of their choice.

Optional maintenance can be included within the contract further setting your monthly outgoings.

The GMFV (balloon payment) provides the customer with the �piece of mind� that they will not be out of pocket should the car be valued below the GMFV (and therefore worth less than is owed) at the end of the agreement (subject to the condition of the vehicle and mileage when returned).

Final balloon payment allows you to purchase the vehicle at the end of the agreement.

It allows customers an affordable, low-risk funding package that has the flexibility to meet their driving needs now and in the future. It is a real alternative to traditional funding.

It allows the customer to know the �least amount� the car will be worth at a fixed-point in the future.

The customer is in control of the options available at the end of the agreement.

Car Credit Assured will make buying the car you want easy!

1. Call or apply online - our finance team today on 0330 108 3793.

2. Get a decision - We will search our panel of lenders to ensure the best result for your credit status and call you with a decision as quickly as possible.

3. Arrange an appointment - To ensure you receive the best possible experience we will call you and arrange an appointment at one of our dealerships at your convenience.

4. Pick up your car - Once all documentation is received we aim to have you driving away as soon as possible.